A 2024 peer-reviewed study in Criminology found that about 60% of people had at least one false positive in their reports, and nearly 90% had at least one false negative. So they’re systemic issues you have to design around.

In this article, you’ll see:

- What false positives in background checks and missed records in background checks really mean for your business.

- Why they happen.

- How they impact revenue, renewals, and client trust.

- What you can do—technically and operationally—to fix them fast.

What Are False Positives and False Negatives?

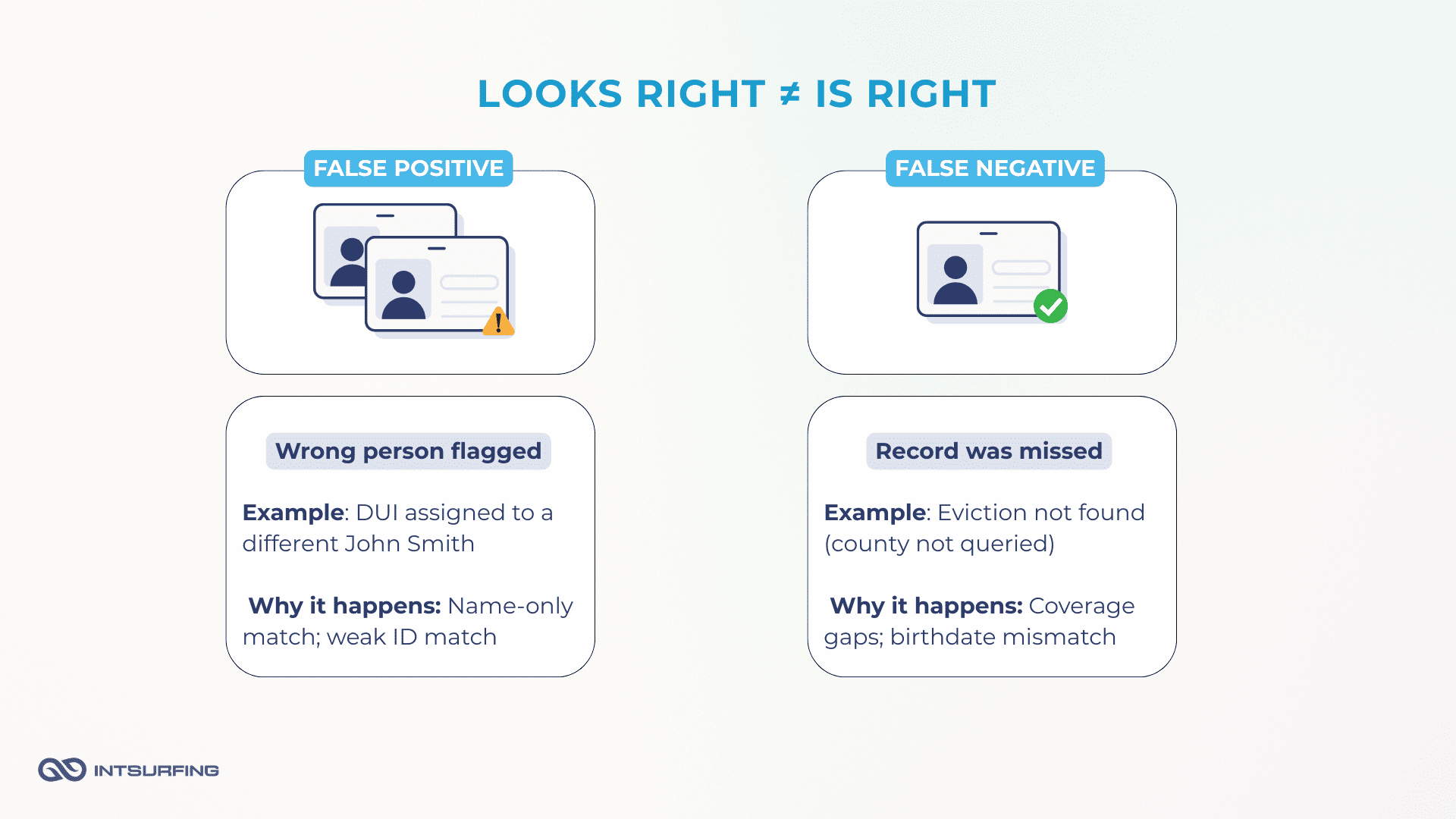

False positives happen when someone gets tagged with another person’s record. It might be a DUI tied to another John Smith or an eviction linked to a similar name. On paper, it looks like a legitimate hit. In reality, it’s someone else’s history.

False negatives are the opposite. The record exists, but it doesn’t show up—maybe because a county system wasn’t queried, or a state repository missed a birthdate. On the report, the person looks “clear.” They’re not.

Both mistakes are costly:

- False positives frustrate applicants and drive disputes.

- False negatives expose your clients to risks that make headlines.

Either mistake forces you into costly rework instead of scaling client growth. But before talking about the impact, let’s find out why these inaccuracies occur in the first place.

Root Causes of Data Quality Issues

When a background check goes wrong, the failure point is usually traceable. Here are the most common ones—and how they show up in your business.

Imperfect Data Aggregation Techniques

If you still link records on name, alias, and DOB, expect mismatches. Sure, biometrics aren’t always available. But this is exactly where criminal record mismatches start:

- Two similar identities collapse into one, and you get a false positive.

- Or a missing alias pushes the system the other way, and the record your client needed never appears.

Incomplete or Outdated Databases

Even with perfect matching, gaps in databases undermine accuracy. State repositories, the FBI’s III, and local systems all have blind spots.

A Virginia State Crime Commission research in 2018 found more than 750,000 offenses—including hundreds of serious crimes—were missing from the database because fingerprint cards were never captured.

Timing adds another layer of risk. The BJS/SEARCH Survey of State Criminal History Systems (2022) found that in some states (e.g. Indiana and Kansas) final court dispositions take more than a year to reach repositories. For you, that means a new conviction can be invisible in statewide or national checks for months—while your clients assume you’ve covered it.

Omission of Disposition Information

Pulling a case is only half the job. Without the final disposition—dismissed, reduced, or convicted—you hand the client an incomplete story.

A GAO review (2023) found that as of 2020, eight states had dispositions on 50% or fewer of their arrest records. The BJS 2022 repository survey reported the same uneven coverage across states. That’s why enterprise buyers increasingly demand to see how you source and reconcile dispositions before signing.

Inclusion of Legally Restricted Information

Expunged or sealed records should never appear in reports.

Under the Fair Credit Reporting Act (FCRA), providers are required to use “reasonable procedures” to keep them out. If they do show up, you’ve created a textbook false positive: a client sees disqualifying information that legally can’t be used.

When expunged records reporting slips through, you’ve turned a technical error into a legal liability.

Duplicative Information

When the same case arrives from multiple feeds and isn’t deduplicated, a single incident can look like several. This is a known failure mode: according to FTC, regulators have specifically called out “multiple entries for the same eviction case” appearing in tenant screening files due to poor procedures.

Obsolete Information

The FCRA limits how long certain non-conviction data can be reported—generally seven years. Get reporting windows wrong, and you expose clients to data they’re legally barred from using.

Human Error and Intentional Inaccuracies

Finally, there’s the simple human factor. Typos, misread documents, and clerical mistakes happen. Then there’s applicant deception—people providing false or incomplete identifiers in hopes of passing a check. Without strong verification steps, these can slip through.

Every one of these causes is a business risk. Unless you treat data quality in background screening as a strategic priority, you’ll keep paying for avoidable errors.

Grave Consequences for Individuals and Organizations

Errors don’t stay “inside the report.” They ripple into hiring, housing, disputes, renewals—and your P&L. Here’s where you feel the impact most.

Denied Opportunities

When a background check is wrong, the cost shows up fast. A job, an apartment, or a promotion gets denied—and suddenly it’s your problem.

- Employment: In July 2024, ADP Screening and Selection Services settled a lawsuit after a report falsely labeled a candidate as a convicted murderer. The case was dismissed after settlement, but buyers now read cases like this as employment background check mistakes—and they expect you to prove it can’t happen again.

- Housing: In 2023, the FTC and CFPB required TransUnion and a rental-screening subsidiary to pay $15 million. Regulators alleged that tenant screening inaccuracies—such as incomplete or misleading eviction records—could lead to wrongful denials. They also flagged gaps in disclosing third-party data sources. For you, that means more scrutiny in RFPs, tighter diligence, and heavier evidence requests.

- Industry credibility: In 2020, AppFolio paid $4.25 million to settle FTC allegations that it failed to follow accuracy requirements (non-conviction items older than seven years, identity mismatches, missing dispositions, duplicate entries). That kind of miss raises buyer skepticism before you ever pitch.

Inaccurate reports don’t just affect applicants. They extend review cycles, increase evidence demands, and lower win rates across industries.

Difficulty and Expense in Correction

When a consumer disputes a report, you’re on the clock: 30 days to reinvestigate (45 if they send new information). If you can’t verify the item, you must correct or delete it. That means pulling fresh records, validating identifiers, reconciling conflicts, documenting outcomes, and issuing results—fast.

The pattern is the same with credit report errors and background checks: files are hard to access, fixes are slow, and costs bounce straight back to your team.

From the applicant’s side, it’s just as painful. The CFPB’s Consumer Snapshot: Tenant Background Checks found that renters often:

- Can’t see the same report their landlord used.

- Pay repeated application fees after denials.

- Struggle to find which vendor supplied the negative item.

All of that drives them back into your pipeline—with more disputes and more calls.

Identity checks add another layer. Under Regulation V §1022.123, you must set proof-of-identity requirements before disclosing a file. If those controls are too rigid (or unclear), consumers can’t access their reports or dispute in time. The result? The same errors keep coming back to you.

If you don’t design for reinvestigations, unit costs rise, SLAs wobble, and your team wastes cycles reopening the same tickets.

Operational Inefficiencies for CRAs and Clients

Disputes don’t just add tickets—they trigger audits. Recent CFPB background check enforcement shows how sloppy pipelines become expensive remediation projects.

In 2023, the CFPB received about 1.31 million credit/consumer-reporting complaints and sent 84% to companies for response. That’s your reality: reinvestigation work is a permanent, resourced function.

Every preventable error increases handle time: recruiter follow-ups, candidate calls, adverse-action notices, re-orders, duplicate case work. Vacancies linger. Compliance reviews spin up. The pipeline clogs. You feel it as missed SLAs, extra FTE in support, and higher cost per screen.

Reputational Damage

Accuracy is a trust product. Public stories about criminal history reporting errors don’t just hurt one brand—they raise the bar for everyone competing in enterprise RFPs.

Recent enforcement actions have become part of the procurement checklist:

- National Public Data (2024): a massive data breach exposing 2.9 billion records led to bankruptcy and multiple lawsuits, effectively erasing the brand’s credibility.

- SafeRent Solutions (2024): a class action over algorithmic tenant screening discrimination resulted in a $2.2 million settlement and damaged its reputation as a trusted AI screening provider.

- ClearStar (2024): the company agreed to a $5.695 million FCRA settlement after reports falsely labeled applicants as “deceased,” a failure that raised serious questions about data accuracy controls.

These judgments shape how buyers run diligence. They’ll demand to see identity resolution, deduplication, disposition handling, and legal-eligibility filters—or you’ll face longer sales cycles and heavier evidencing.

Public actions become the buyer’s script. If you can’t demonstrate controls that fix these failure modes, win rates slip and discount pressure rises.

Solutions for Better Data Quality

There’s no single silver bullet. But if you tighten the system end to end, you move the numbers. Here’s what’s working now—and what’s next. And for a broader view on emerging product-side trends in 2025, see Top Background Screening Trends in 2025.

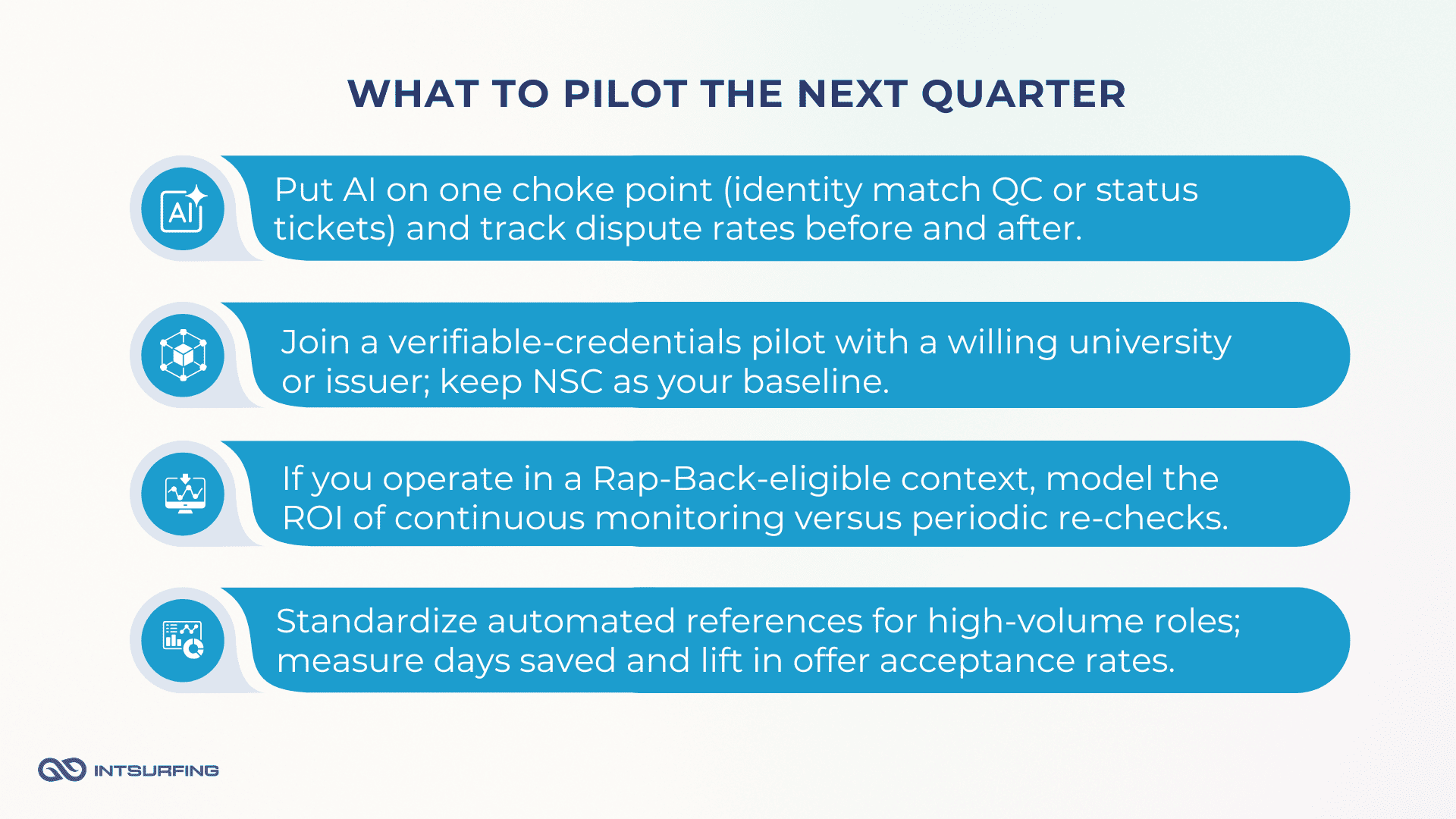

Artificial Intelligence (AI)

Use AI where it cuts rework and tickets. Two areas deliver the fastest gains: adjudication and transparency.

- Adjudication: Checkr reports that its Assess rules reduce manual review by up to 85% across 235 criminal categories. A Predibase case study showed automated adjudication removed ~95% of manual reviews on edge cases. Fewer handoffs, fewer inconsistencies, faster SLAs.

- Transparency: Showing candidates accurate ETAs lowers noise. Checkr customers saw up to 71% fewer “where’s my report?” tickets when ETAs were visible.

Use AI as quality gates, not a black box: block releases when dispositions are missing, suppress duplicates, filter sealed/expunged hits, and flag stale items for review. That’s directly in line with the CFPB’s January 2024 advisory on “maximum possible accuracy.”

Verifiable Credentials (Blockchain) for Education & Work History

The W3C Verifiable Credentials Data Model v2.0 became an official web standard in May 2025. Why does it matter? Because it gives HR tech and CRAs a stable way to verify degrees, licenses, and work history without PDFs and endless phone calls.

Real-world pilots are already here: Gen Digital (Norton/Avast) launched a 2024 program that let HR teams verify candidate claims “in seconds” using digital credentials.

Short term, you’ll still rely on established pipes like the National Student Clearinghouse for degree checks at scale. Verifiable credentials will complement—not replace—those feeds where issuers participate.

Biometric Identity

Biometrics reduce both false positives and false negatives by anchoring the record to the actual person. You don’t need them everywhere. Use them where risk is continuous (cash handling, healthcare, transport) or where identity fraud is costly (regulated roles).

For post-hire risk, the FBI NGI Rap Back service lets authorized employers and regulators receive ongoing criminal-history notifications after enrollment. That reduces the need to re-fingerprint and closes blind spots between periodic checks.

Providers already ship this. Sterling offers biometric facial recognition with liveness for digital ID verification. HireRight runs Global ID for remote checks across 200+ countries. These are off-the-shelf controls you can turn on without a rebuild.

Automated Reference Checks

Manual references are slow and inconsistent. Automated platforms compress cycle time dramatically. Xref cites an average 18-hour turnaround for completed references, and surveys show faster time-to-hire in most programs.

Universities and enterprises (like Texas A&M) publicly recommend these tools to speed hiring. The upside: faster closes, standardized questions, structured signals for adjudication, and an auditable trail that works well in compliance reviews.

Predictive Analytics

Predictive models are most useful for prioritization—figuring out which files need human review or which verifications are likely to stall. That’s where you see tangible impact on turnaround time and costs.

Case in point: First Advantage helped Liveops move from 14 days to 70% same-day and 96% within one week after a modernization push. That’s orchestration, not just prediction—but it shows what data-driven workflows can deliver. For more on how strong pipelines and engineering practices support this shift, see Data Engineering in Background Screening.

Stay on the safe side of the legal line: use models to route and prioritize; keep adverse-action decisions tied to verified facts and documented criteria.

Crowdsourced / open data

Open and third-party datasets can help corroborate claims—professional registries, licensing boards, sanctions lists. But regulators expect you to disclose sources and ensure accuracy.

The mentioned above FTC/CFPB’s 2023 order against TransUnion’s rental-screening unit is a reminder: missing dispositions, duplicates, and opaque pipelines lead to fines and mandated fixes. If you use auxiliary data, keep provenance clear and deduping tight.

Improved Data Practices and Best Practices

Accuracy can’t live in policy statements alone—it has to be operational.

Make Accuracy a Program, Not a Promise

Write down your “reasonable procedures” the same way regulators expect you to:

- Always include dispositions when available.

- Suppress duplicates.

- Filter out sealed, expunged, or juvenile items.

- Apply lawful time windows—seven years for non-convictions; convictions per state rules.

The CFPB’s January 2024 advisory is clear: you’re not assuring “maximum possible accuracy” if these controls aren’t in place.

Then, make reinvestigations boring and predictable:

- Stick to the 30/45-day clock.

- Always do fresh pulls.

- Put controls in place, so removed items don’t creep back in through another feed.

When consumers ask for their file, disclose everything—including the original source and any intermediaries—per the CFPB’s January 2024 file disclosure advisory. That transparency speeds up fixes and cuts down on back-and-forth.

If you want a public, auditable benchmark, aim for PBSA accreditation (2024 standard). It requires written accuracy procedures and identity confirmation before reporting—language you can lift directly into your SOPs.

Get the Person Right, Then the Event

Accuracy starts with identity resolution. Use multiple sources—national/state repositories, county courts, and registries—and reconcile them into one identity and one event before delivering results.

Dispositions are still uneven across states. SEARCH’s July 2024 analysis found some states below 50% coverage, others above 90%. That’s why you hold items without dispositions and go back to the court of record.

This is where entity resolution matters: linking name variants, DOBs, case numbers, and addresses so you avoid both false merges and missed matches. If you want a pattern to follow, here’s our approach to entity resolution in complex data sets.

For context on how fingerprints, state SIDs/UCNs, and III records flow, the BJS/SEARCH 2022 national survey is still the best reference. It shows why many dispositions stay at the state level unless you fetch them directly. Build your pipeline with that reality in mind.

Build on Rails: Integrate and Show Your Work

Most avoidable background screening errors happen in the seams—between your client’s ATS and your fulfillment stack.

Push ordering, status, adverse action, and disputes directly into the ATS/HRIS (no re-keying). Pass a unique case ID and the final disposition all the way through.

For clients, it looks like seamless marketplace integrations (think Checkr or HireRight catalogs). For you, it means fewer handle-time minutes and fewer missed notices.

When you do take adverse action, follow the FTC’s employer guidance to the letter: pre-adverse notice + copy of the report, then final notice. That way candidates can actually correct errors. Tight adverse-action workflows and full report copies aren’t optional—they’re how you stay out of stories that turn into FTC background check violations.

Verify Fast—at the Source—and Keep Watching

Shortcuts are fine if they’re defensible. In healthcare, “defensible” means primary-source verification:

- For nurses: Nursys, the national database fed by state boards.

- For physicians: AMA Physician Profiles, accepted by hospitals and boards.

These are the issuer-grade pipes you should favor over screenshots and PDFs.

When verifiable credentials exist, use them. The W3C Verifiable Credentials 2.0 standard makes machine-verifiable education and employment proofs practical. Where they’re not available, fall back to the issuing authority and document the call.

For roles where risk continues after day one, take a page from the federal playbook. Trusted Workforce 2.0 moved cleared populations to continuous vetting, and the GAO’s 2025 review shows it improved timeliness and risk detection (with some IT challenges). Use that model selectively—cash handling, healthcare, transport—with clear consent and proper adverse-action steps.

Conclusion

Data quality isn’t optional. It’s your renewal rate, your dispute load, and your brand—rolled into one.

The path forward is practical: pair technology that already moves the numbers—AI quality gates, verifiable credentials, stronger ID proofing, ATS-first workflows—with a documented accuracy program. That means:

- Dispositions included.

- Duplicates suppressed.

- Restricted records filtered.

- Time windows enforced.

- Reinvestigations that actually close.

Do this, and you cut false positives that block qualified people and background screening false negatives that put clients at risk. At the same time, you stay aligned with regulators and meet the standards enterprise buyers use to measure you.

Get this right, and you don’t just stay compliant—you win faster renewals, close enterprise deals, and run a business your clients actually trust.

If you want help pressure-testing any of these pieces, here’s where to start: background screening data services**.**